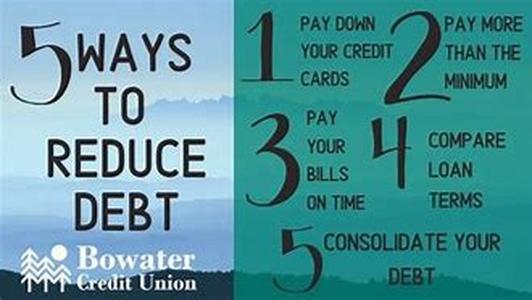

KWD: 17460 3.69Auto Loan Automobile FinancingAuto Loan Automobile Financing Can Be Reduced To A Minimum If You Have A Good Credit Score. You Can Apply Several Rules In Order To Get The Most Out Of Auto Loan Automobile Financing. First, You Are Required To Know You Credit Score. Another Is To Know The Current Auto Loan Rates. This Is Necessary In Order To Make Comparisons Among The Different Lenders That Offer Auto Loan Automobile Financing. A Good Credit Score Is An Important Consideration When Applying For Auto Loan Automobile Financing. Just Because You Never Missed Payment On Your Auto Loan Automobile Financing Doesnt Mean That Your Credit Score Is High. Paying On Time Is But One Of The Numerous Variables That Comprise The Credit Score. Having A Number Of Credit Availed Of Will Lower Your Credit Score Because Of The Possibility Of Spending Up To The Credit Limits. A Credit Account Balance That Is Above 50 Of The Credit Limit Decreases Your Score. Before You Avail Of Auto Loan Automobile Financing For Your Vehicle Make Sure That You Have Your Credit Score With You. This Way, Dealers Cant Charge You With Higher Interest Rates. You Should Also Compare Auto Loan Rates Of Different Car Dealers. If You Just Graduated From College, Do Not Apply For Auto Loan Automobile Financing Until You Have Worked For At Least 6 Months. You Should Apply At A Reputable Lending Company Whether Online Or Offline. Dont Settle For Auto Loan Automobile Financing Companies That Render Poor Service And Have A Number Of Hidden Charges. Try To Improve Your Credit Standing Before Applying For An Auto Loan Automobile Financing. Aim For A Credit Score Of At Least 680. Pay Your Credit Card Balances And Lower It To The Minimum. If You Have Moved In For The Last Six Months, Try Not To Apply For Auto Loan Automobile Financing. Lenders Need Verifiable Addresses And Income. So, Established Them Before Applying. Previous Auto Loan Automobile Financing Record Or A Home Mortgage Can Help. Before You Approach A Lender For Auto Loan Automobile Financing Make Sure That You Have Removed Previous Errors Off Your Credit Report. Find A Stable Job Such As Finance, Engineer, Etc. Self-employment Rarely Gets Approved. Negotiate With Creditors On Late Payments, Charge Offs And Other Negative Marks On Your Credit Report Before Applying For Auto Loan Automobile Financing. If You Do Any Of These Steps, It Could Spell The Difference Of A Few Hundred Dollars To Even Thousands Of Dollars Off Your Auto Loan Automobile Financing Rate. It Also Helps To Pay A Huge Down Payment On Your Auto Loan Automobile Financing To Bring Down Your Auto Loan Payment. You Could Give Refinancing A Try To Lower The Interest Rates Of Your Auto Loan Automobile Financing.