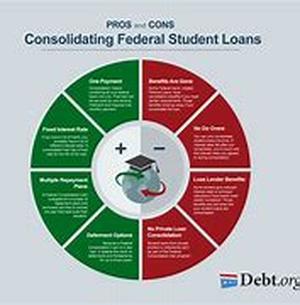

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: Government Student Loan Consolidation Is A Great Tool That Can Be Used To Get A Worry Free Start In Life. The Majority Of College Graduates Face Overwhelming Debt That Has Accumulated During Their College Years. This Problem Is Compounded When Buying A Home And Starting A Family, All Of This Debt Puts A Lot Of Pressure On You As You Try To Start Your Career. Government Student Loan Consolidation Gives You The Opportunity To Lower Your Monthly Bills And Pay A Lower Interest Rate Than You Would Have Had Previously.There Are Several Plans That You Can Take Advantage Of When Choosing The Right Debt Consolidation Program.It Would Be In Your Best Interest To Review And Evaluate Each Of These Plans To Find Out Which One Suits You Best. Many Financial Institutions Have Counselors Than Can Also Help You Make Choices About Plans. You Should Carefully Consider Your Options And Choices, Interest Rates Are Very Low And Will Probably Rise Soon So Now Is Your Best Opportunity To Take Advantage Of Government Student Loan Consolidation Programs. For Many People This Makes Managing Your Monthly Bills Easier.Benefits Of Debt Consolidation Include: Lower Payments, Lower Interest And If Done Correctly You Can Improve Your Credit Rating. Improving Your Credit Rating Can Pay Major Dividends Now And In The Future. Your Credit Rating Is Becoming More Important Everyday, Companies Are Beginning To Look At Your Credit Rating For Things Besides Loans. Your Credit Rating Can Effect Your Ability To Get Insurance And Even A Job.Title: Why Do I Need Student Loan Consolidation Source: Http:financeequityloans.comCategory: Student LoansArticle Body: Government Student Loan Consolidation Is A Great Tool That Can Be Used To Get A Worry Free Start In Life. The Majority Of College Graduates Face Overwhelming Debt That Has Accumulated During Their College Years. This Problem Is Compounded When Buying A Home And Starting A Family, All Of This Debt Puts A Lot Of Pressure On You As You Try To Start Your Career. Government Student Loan Consolidation Gives You The Opportunity To Lower Your Monthly Bills And Pay A Lower Interest Rate Than You Would Have Had Previously.There Are Several Plans That You Can Take Advantage Of When Choosing The Right Debt Consolidation Program.It Would Be In Your Best Interest To Review And Evaluate Each Of These Plans To Find Out Which One Suits You Best. Many Financial Institutions Have Counselors Than Can Also Help You Make Choices About Plans. You Should Carefully Consider Your Options And Choices, Interest Rates Are Very Low And Will Probably Rise Soon So Now Is Your Best Opportunity To Take Advantage Of Government Student Loan Consolidation Programs. For Many People This Makes Managing Your Monthly Bills Easier.Benefits Of Debt Consolidation Include: Lower Payments, Lower Interest And If Done Correctly You Can Improve Your Credit Rating. Improving Your Credit Rating Can Pay Major Dividends Now And In The Future. Your Credit Rating Is Becoming More Important Everyday, Companies Are Beginning To Look At Your Credit Rating For Things Besides Loans. Your Credit Rating Can Effect Your Ability To Get Insurance And Even A Job.