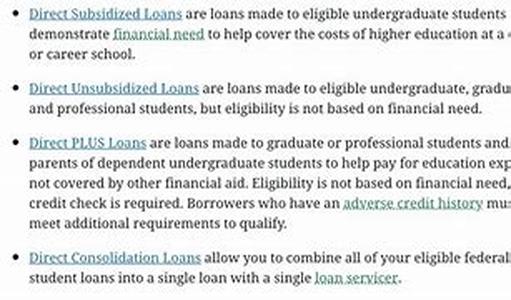

Source: Http:financeequityloans.comCategory: Student LoansArticle Body: The Major Factors Considered When A Student Wants To Pursue His College Education Are The Low Interest Student Loans. These Are Main Concerns Since The Student Or The Parents Will Be Paying For This Interest Charge On Top Of The Total Loan Amount For A Very Long Period Of Time.A Bank Loan Can Be An Option And Most Offer Student Loans As Well. If The Credit Status Of The Applicant Is Of Good Standing, He Has A Big Chance Of Getting Lower Rates And Is Approved Fast. This Is Good For Those Who Have Not Passed The Qualifications For The Federal Student Loans. If One Can Make It Through The Government Qualifications, He Is Best Recommended To Pursue The Federal Loans Since These Have The Lowest Interest Rates In Town.The Loans That Are Granted By The Government To Deserving Individuals Are Usually Low Interest Student Loans That Charge About 3. This Is Very Helpful Since The Parents Will Find It Easier To Pay For This Eventually. During The Entire College Education Process, The Loans Will Possibly Pile Up So It Is Really Crucial To Find Only Those That Can Offer The Best Rates. The Lowest Rates Can Help Save A Great Deal Of Money For The Student And The Parents Who Are Going To Pay For The Loan After Graduation.The Best Thing About The Federal Student Loans Is That The Government Can Subsidize For The Student During His Stay With The School He Chose To Enroll At. The Government Will Pay For All The Interest Charges Until After The Six Months Grace Period When Student Graduates. There Is An Option To Pay The Interests Only While In School. This Can Help Shorten The Payment Terms And Lower The Total Loan In Effect.Some Private Lenders And Banks Offer The Same Payment Terms And Packages But The Down Side Is That There Is No Grace Period Offer Like That Of The Federal Loans. These Private Loans Also Often Start Collecting Immediately Upon Beginning The Loan. This Can Be A Huge Burden To Parents Since College Education Could Really Be Very Expensive. There Are So Many Other Things In The Household To Spend On Too.This Is Why The Government Student Loans Are A Student's Best Bet For Financing His Studies. It Is Better Since Most Students Will Qualify So That Part Of Their Schooling Expenses Can Be Covered.When Payment Time Comes, Money Can Be Saved If Extra Payments Can Be Made. This Will Help Shorten The Payment Term And Also Save Up On A Lot Of Interest Charges That Can Be Eating Up A Lot Of The Extra Costs. Check With The Lender If This Option Is Available Without Any Charges. For Most, There Isn't Any Penalty For Early Payments.The Trick Too In Maintaining Any Type Of Loan Such As The Low Interest Student Loans Is To Pay The Required Amount On Time. This Gets You Good Scores On The Credit Record Too, So It Will Benefit You In The Future In Case You Decide To Obtain Other Types Of Loans.